Leverage Retirement Plan - You can take advantage of 3X funding into your plan with 60%-80% more in Tax Efficient Retirement Income

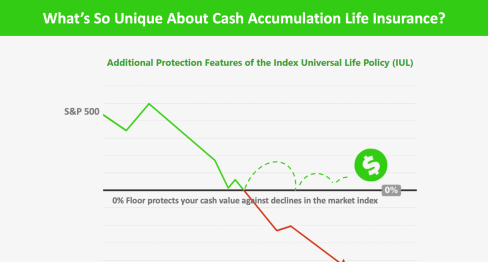

Take advantage now with our unique leverage strategy typically used by the high net worth clients now available to professionals whose goals are family protection, wealth accumulation, and tax efficient retirement income. (English only)

Simon's TV Show on Leverage Retirement Plan (Mandarin with English subtitle)

【生活百分百】保險理財專家趙世文詳解頂級退休理財組合: 8 倍收益 終身免稅收入 兼獲萬全寶

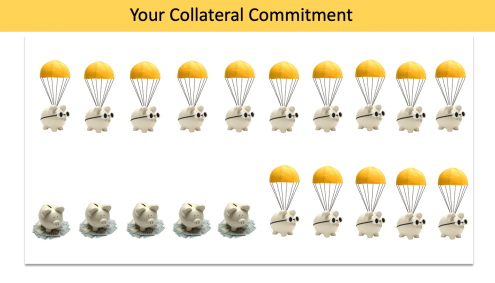

How does leverage work ?

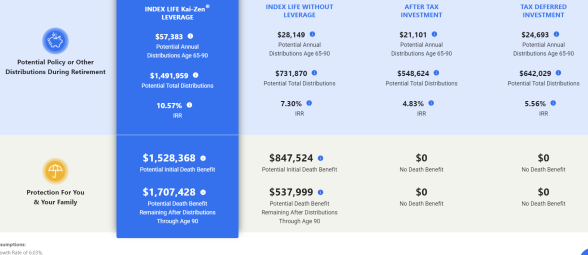

Leveraged Tax Free Income vs. Self Funding vs. After Tax Mutual Fund investing vs Tax Deferred 401k/IRA investing

Leverage Income = $57k/yr age 65-90 total almost $1.5M along with Life/LTC Insurance Protection of $1.5M as compared to "No Leverage"=$28k/yr with lowered Insurance Protection; "After Tax Mutual Fund"=$21k with NO Insurance Protection, "Tax Deferred 401k/IRA"= $24k/yr with NO Insurance Protection

Based on 6% Index Credit Rate & 20% Capitals Gain Tax Rate

Based on Female, age 50, contribute $35k/yr x 5 yrs total of $171k, Bank Match total of $457k