9 Things You Must Know About Long Term Care

1. Health insurance doesn't cover LTC services

LTC generally focuses more on caring than on curing. LTC is the assistance, care or service that a person needs when they cannot perform basic activities of daily living, such as bathing, dressing, or eating.

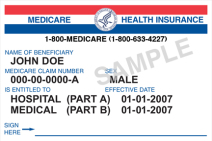

2. Often, government programs don't meet LTC needs

Medicaid has rules and requirements about which LTC services are covered and state-specific poverty guidelines, which can require families to spend-down their assets. Medicare is a senior health insurance plan that covers skilled care designed to improve a patient's health condition. It does not cover custodial care. Additionally, these programs often don't provide home care.

3. Paying out-of-pocket can deplete your savings quickly

The average annual costs for LTC services in California are $52,519 for care at home, $44,520 for care in an assisted living facility, and more than $97,000 for care in a nursing home (private room), according to the National Clearinghouse for LTC Information. For this reason, many consider LTC insurance to be an integral part of a person's financial plan.

4. LTC Insurance covers much more than "Nursing Home Care"

LTC insurance plans allow policyholders to get care in the setting they prefer. LTC insurance can provide benefits for home care for thosse who prefer to age in place, as well as for care in an adult day care, hospice center, assisted living facility or nursing home. In fact, most newly opened LTC claims are for home care. Waiting for a crisis or going without a LTC plan severly limits one's options.

5. LTC insurance is more affordable than you think

Can you afford $270,000? That's the cost for 3 years of LTC in California (6 months of home care, 2.5 years in a nursing home), which is the average duration of need, according to the National Clearinghouse for LTC Information. Many LTC insurance plans are designed to fit a range of budgets with benefit levels that fit personal needs. Having some protection from the financial demands of LTC is better than having none; it doesn't have to be an all-or-nothing decision.

6. Age and Health make a BIG difference

Many people put off LTC planning, which can be a costly mistake. Age and health are 2 of the most important factors when applying for LTC insurance. The younger and the healthtier you are, the more likely you will qualify for a lower premium. Additionally, accidents and chronic illness, which can happen at any age, can necessitate extended custodial care. The bottom line is that LTC insurance is not just for older seniors; the earlier you start planning, the better.

7. Optional features can make coverage more affordable and flexible

Many LTC products offer a shared care feature that allows couples to share their benefits even if one policy is exhausted and care is still needed. You can also consider LTC insurance policies that qualify for LTC Partnership Program which protects a portion of your assets from Medicaid spend-down requirements if a policy is exhaused and care is still needed.

8. LTC Insurance supports family caregivers

Family and friends play an important role in LTC. When this care is prolonged, it can bring significant strain to the caregiver - physically, emotionally and financially. LTC insurance can help supplement such informal care and ensure that care is received if a spouse or family member isn't physically capable of providing care.

9. LTC a critically important issue especially for women

LTC truly is a women's issue. Women make up 66% of our nation's caregivers, according to the National Alliance for Caregivers. The burden of caregiving affects their finances, health and family. Consider the following:

- Women live longer than men and generally will need longer period of LTC

- As primary caregivers, many women use their retirement savings to care for their spouse, living little or nothing for their own care

- Women make sacrifices at work due to their caregiving roles, such as passing up promotions, cutting their hours or even quitting all together

- Elderly women are far more likely than men to run out of resources and end up in poverty